CLUSTER BUYING

Are Insider's Actually Better Than The Market?

92,769 is how many datapoints we analyzed for the graph above. Each data point is an insider buying a company. The green line is what would happen if every time an insider bought you put one dollar in a jar, at the end you'd have $92,769, the same as you started with. The orange and blue lines show you how much you'd have if you put that same dollar on the S&P500 or the company that the insider bought respectively.

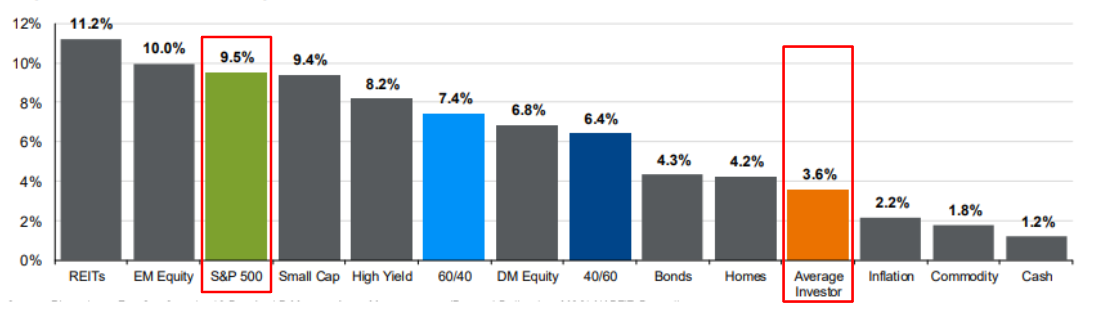

Is that even impressive? They look about the same? True, but there's two things to think about. First, this is following every insider buy, even the ones the board demanded the CEO make on companies clearly going bankrupt in a desperate attempt to stop stock price freefall. Second, the average investor (and average hedge fund for that matter) significantly underperform the S&P. See JPMorgan's annualized return by asset class below, comparing the S&P500 and average investor outlined in red.