INSIDER TRADING

Congress vs Insiders

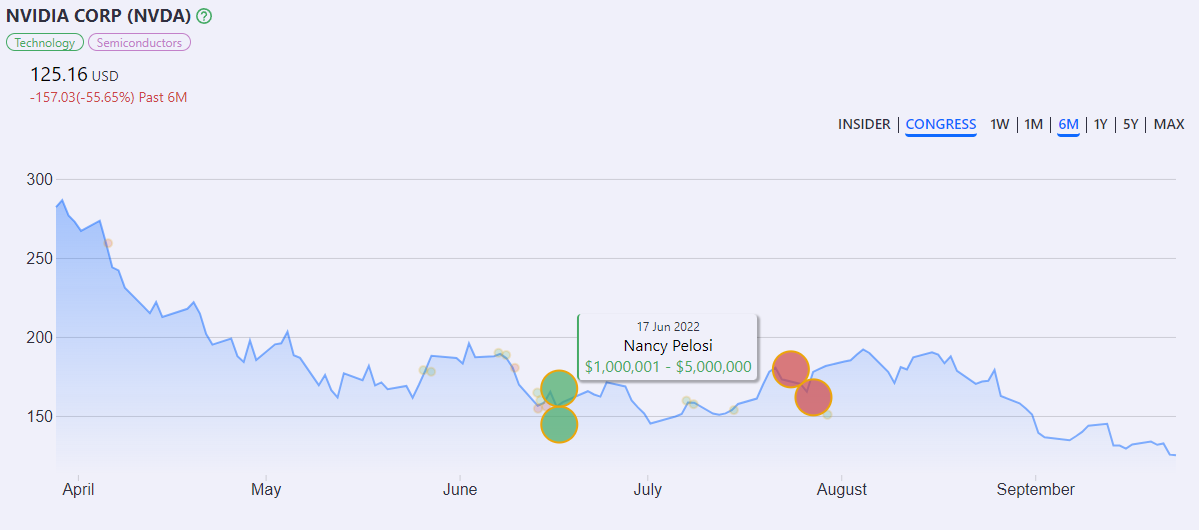

The differences in regulation for congress and company insiders is quiet startling. Firstly, where members of Congress have 60 days to report their trades company insiders only get 48 hours. Another, huge point is that if insiders profit from buying and selling within 6 months they have to give up all profits, whereas seen above congress gets away with it just fine.

Is the information they have materially different? This question could be answered many ways. In a broad sense not really, both have knowledge not accessible to the public on account of their station that could be easily used to predict stock market movements. The definition of insider trading uses the words, "material non-public information", which clearly describes both groups.

On the other hand, the types of market trends they can predict is quite different. Congress far outperforms the public in cases of national crisis such as when COVID started and representatives knew details before their constituents. While company insiders are a stronger indicator when it comes to the sentiment of specific companies that they know every metric about. While we find this interesting as followers of insider trading, it should be of no object to regulators.