INSTITUTIONAL INVESTORS

Institutional Investor Data on InsiderViz?

An Institutional Investor is a company that manages money on behalf of clients. These include hedge funds, mutual funds, endowments, large asset managers, and more. The SEC requires disclosure of institutional investors' equity holdings every quarter for managers with at least $100 million in assets under management(AUM) in the Form 13F. These reports give the average investor a peak into what the big money investors are doing.

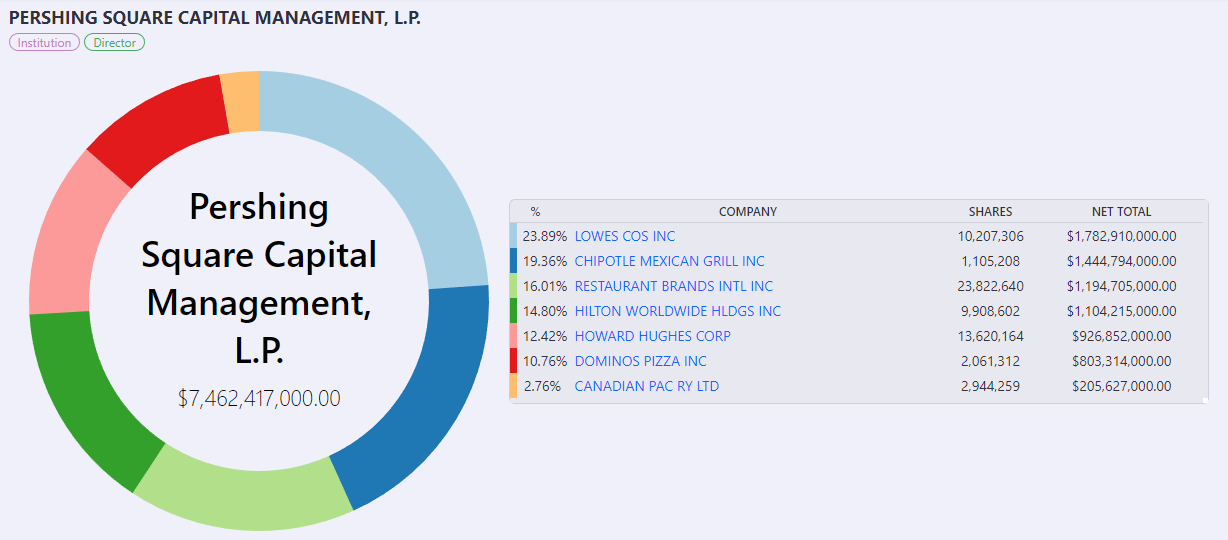

Activist Investors As mentioned before there are many types of institutional investors, a significant type for insider trading are activist investors. Most activist investors are hedge funds, who buy a significant enough stake in a company in order to change how it’s run. This could be for simple management changes or a complete turnover of the company. This usually results in a share price increase at the time of the purchase. Bill Ackman, CEO of Pershing Square, is one of the most well known activist investors. We can see Ackman only holds a few companies he is more deeply invested in. His actual trades as well as his public influence, can completely flip how a stock is viewed.

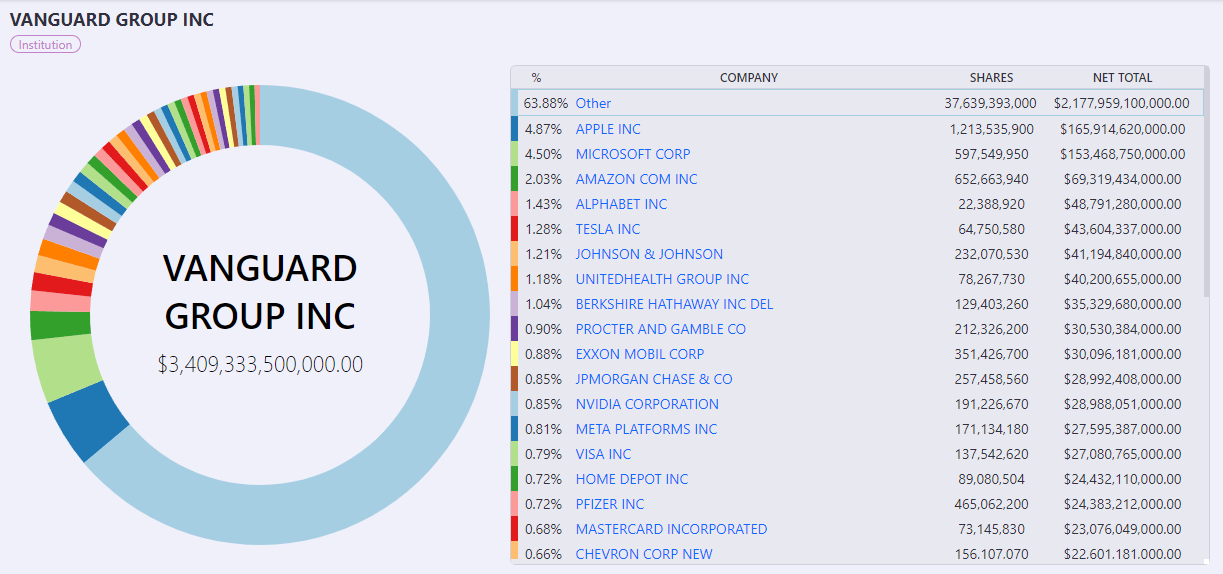

Asset Managers On the opposite end of the spectrum to activist investors are large asset managers. These companies typically have large AUM, reaching into the trillions of dollars. The largest control amounts larger than any sovereign wealth fund. They offer index funds, so they own part of almost every single stock to offer it in one of their packages. Index funds allow investors to track the performance of a larger group, like the S&P 500 or a specific sector. The simplicity allows for passive investing through significant diversification. The Vanguard Group doesn't own the $3.4 trillion, they just invest it on behalf of their clients to track a given index.