INSIDER SENTIMENT

Another red month in insider trading, what can we learn?

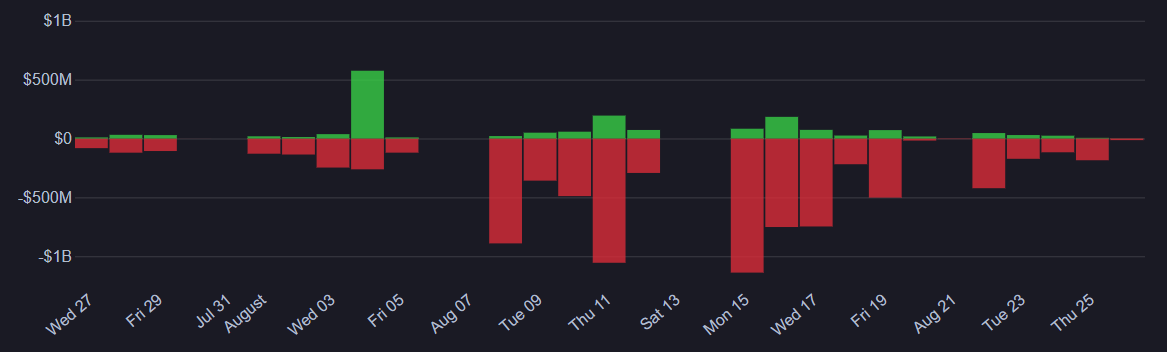

There was only one day in August so far where across all Form4s insiders bought more than they sold. On August 4, Warren Buffett and Jeffrey Ubben greatly increased their stakes in Occidental Petroleum and Exxon Mobile respectively. Otherwise, its a whole lotta red.

Is insider sentiment always negative? Pretty much. Over the past five years the only time insider buying outpaced selling was in March and April 2020 following the COVID-19 market crash.

Does this mean insider's always expect a crash? Probably not. There are a couple big reasons insiders sell more than they buy. In the case of mature companies, many insiders have owned shares since founding and have therefore seen incredible returns meaning the only thing left for them to do is realize gains by selling. The richest men in the world are minted in this way. This appears as negative sentiment as less money went in than came out but, in truth it just indicates compounding returns. Another factor is generous executive packages that grant insider's endless options which won't appear as buying but, certainly appears as selling.